Personal finance can seem overwhelming. Yet with a little effort, you can gain a understanding on your finances and work towards achieving your financial goals. Kick off by tracking your income and expenses. This will give you a clear snapshot of where your money is going. Once you have a good understanding of your spending habits, you can launch to formulate a budget that works your needs.

A thoughtful budget will help you allocate money for unexpected expenses. It will also allow you to invest your wealth over time.

Unlocking Financial Freedom: Practical Tips for Success

Achieving financial freedom is a rewarding journey that requires dedication and calculated planning. While it may seem like an overwhelming goal, remember that every step, no matter how insignificant, brings you closer to your aspiration. Start by establishing a realistic budget that records your income and expenses. This more info will provide a clear snapshot of your current financial situation, enabling you to identify areas where you can minimize spending and maximize savings.

- One proven strategy is to program your savings by setting up regular transfers from your checking account to a dedicated savings account. This secures that you consistently invest towards your monetary goals, even when life gets hectic.

- Another important step is to explore different growth options that align with your comfort level. Diversifying your portfolio across a range of securities can help mitigate risk and enhance your returns over the long term.

- Finally, persistently learn yourself about personal finance. There are many resources available, including books, articles, podcasts, and seminars, that can provide valuable knowledge to help you make prudent financial choices.

Remember, the journey towards financial freedom is a marathon, not a sprint. By consistently adopting these practical tips and staying committed to your goals, you can unlock a future filled with stability.

Mastering Your Money

Crafting a spending strategy is the cornerstone of managing your finances. It empowers you to monitor your earnings and expenditures, gaining valuable understanding into your financial trends.

A well-structured financial plan allows you to set clear financial targets, whether it's saving for a dream, paying down obligations, or simply existing within your capacities.

By implementing a budget, you cultivate financial responsibility and secure your future.

Start Investing Today: The Basics of Wealth Creation

Building wealth over time is a goal that many individuals share. While it may seem difficult, investing can be a powerful way to realize your monetary targets. Investing 101 provides the foundational knowledge needed to navigate the world of investments and start your journey toward financial security.

One of the most essential aspects of investing is building a well-defined financial plan. This blueprint should outline your aspirations, risk tolerance, and investment timeframe. Once you have a clear perception of these factors, you can start to identify investments that match with your individual circumstances.

It is also critical to educate yourself about the diverse types of investments available, such as stocks, bonds, mutual funds, and real estate. Each asset class carries its own set of challenges and opportunities. By diversifying your investments across different asset classes, you can help to reduce risk and increase the chance of achieving your capital aspirations.

Finally, it is crucial to monitor your investments frequently and make adjustments as needed. The market is constantly shifting, so it is important to remain current on trends and modify your investment strategy accordingly.

Strategies for Debt Reduction

Achieving financial stability can seem like a daunting task, particularly when burdened/struggling with/faced by debt. A well-structured plan/strategy/approach to debt management is crucial for regaining control of your finances and setting/achieving/creating long-term stability.

Begin by assessing/evaluating/analyzing your current financial situation. Compile/Gather/Collect all information regarding your income, expenses, and outstanding debts. This detailed/comprehensive/in-depth understanding of your finances will provide a solid foundation for developing/creating/formulating an effective debt management plan/strategy/approach.

Once you have identified/determined/recognized your financial position, explore various/numerous/diverse debt management strategies. Consider/Explore/Research options such as:

* **Debt Consolidation:** Combining/Merging/Aggregating multiple debts into a single loan with a lower interest rate can simplify payments and reduce overall interest costs.

* **Balance Transfers:** Transferring high-interest credit card balances to a card with a lower introductory interest rate can help you save money on interest charges.

* **Debt Management Plans (DMPs):** A DMP is negotiated/structured/arranged with a reputable credit counseling agency that works with creditors to reduce your monthly payments and consolidate your debt.

It's important to choose a strategy that aligns/suits/matches your individual financial circumstances/situation/needs. Remember, achieving financial stability requires discipline/dedication/commitment and consistent effort. By implementing/utilizing/adopting effective debt management strategies and developing/cultivating/building healthy financial habits, you can regain/restore/achieve control of your finances and work/strive/endeavor toward a secure financial future.

Financial Planning for All Stages of Life

As individuals navigate the course of life, their financial needs transform. From beginning adulthood to seniority, effective management is crucial for obtaining goals.

- In young adulthood, focus should be on establishing a strong structure through accumulation.

- Marriage and launching a family often demand adjustments to financial allocations.

- Property acquisition is a significant step that necessitates careful planning.

- In the twilight years of life, seniority preparation shifts to paramount.

By proactively tackling economic matters at each stage of life, people can secure a fulfilling future.

Ross Bagley Then & Now!

Ross Bagley Then & Now! Marla Sokoloff Then & Now!

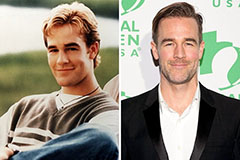

Marla Sokoloff Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Kane Then & Now!

Kane Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!